This is a model response to a Writing Task 1 topic from High Scorer’s Choice IELTS Practice Tests book series (reprinted with permission). This answer is close to IELTS Band 9.

Set 2 Academic book, Practice Test 6

Writing Task 1

You should spend about 20 minutes on this task.

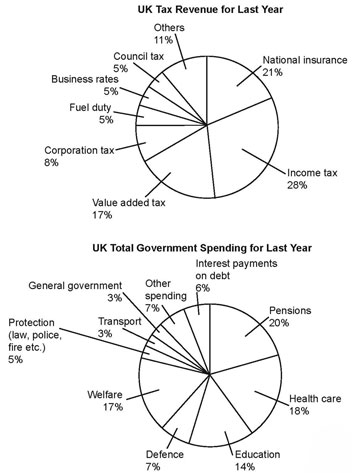

The pie charts below show the sources for UK tax revenue for last year and the total UK government spending for last year.

Summarise the information by selecting and reporting the main features, and make comparisons where relevant.

You should write at least 150 words.

Sample Band 9 Report

This report is describing two pie charts, one that shows the sources for UK tax revenue and another that shows how the UK government spent their money. Both charts show statistics from last year.

It can be clearly seen that income tax was the biggest source of revenue for the UK, and pensions were the largest expenditure area.

The sources that the UK government was most dependent on last year were income tax, which made up 28% of tax revenue, national insurance taxes, which made up 21% and value added tax, which made up 17%. The sources that contributed the least to tax revenue were fuel duty, business rates and council tax, each making up 5% of total revenue. The remaining sources of money for the UK government were corporation tax (8%) and other, undefined sources (11%).

The pie chart describing the total UK government spending for last year shows that most of the money gained from taxation went on pensions (20%), health care (18%), welfare (17%) and education (14%). The least amount of money went to general government and to transport, both areas receiving 3% of the money each. 7% of the money went to other spending, and the remaining money went to defense (7%), interest payments on debt (6%) and protection in the form of law, police, fire department etc. (5%).

Go here for more IELTS Band 9 Reports